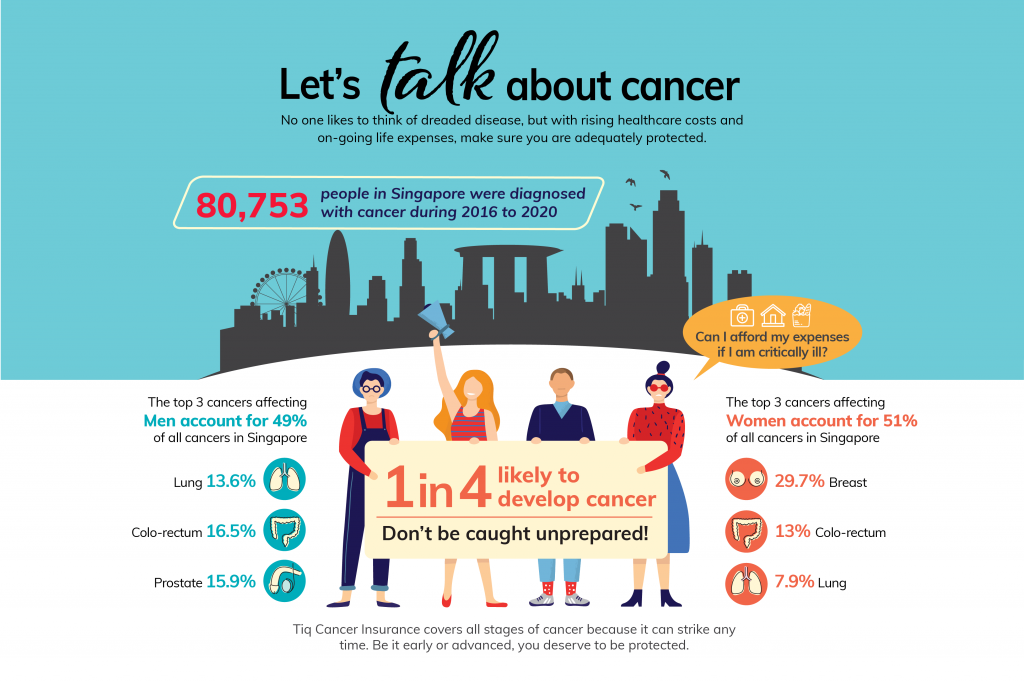

Cancer Insurance

With our Cancer Insurance, you are covered across all stages of cancer so that you can get

treatment minus the worry of high medical costs.

Plus, get 6% yearly savings upon renewal if you stay in good health!

Why Cancer Insurance?

- Yearly renewable policy with 6% savings

Yearly renewable policy up to age 85. 6% savings upon policy renewal if no claims have been made. Terms apply.

- From as low as S$0.27 per day

Premium is based on S$50k cover for a 20-year-old, male non-smoker

- Coverage for all stages of cancer

- Cancer benefit of S$50,000, S$100,000 or S$200,000

- Full payout for all stages, including early stage cancer

- Death benefit of S$5,000

Source: Singapore Cancer Registry Annual Report 2020

We won’t stop until cancer does!

Enjoy 6% yearly savings upon policy renewal if no claims have been made in the previous year. Terms apply.

#tiqcancelcancer

Insured but still looking?

Let us know when your policy ends and we’ll send you a reminder to switch to Tiq by Etiqa Insurance.

Set. Relax. No Regrets!

Don’t worry, we’ll wait for you!

Disclaimer: We will not be held responsible if our reminder doesn’t reach you and you choose to cancel your policy with your existing insurer.

Submit Failed.

Thank you for your submission.

Have questions? We’re here to help

Planning for the future doesn’t have to be daunting. We are here to guide you through it.

Our operating hours are: Monday to Friday, 9.00am to 5.30pm (excluding public holidays)

Frequently Asked Questions

- You are:

- – a Singapore Resident with a valid NRIC; or

- – a foreigner holding a valid Work Permit, Employment pass or Social pass.

- You are between 17 to 65 years of age (age next birthday).

As long as no claims has been made during the previous year policy term, a no claim discount equivalent to 6% of the total premium paid for the previous year policy term will be applied to the renewal premium. We will let you know 30 days in advance if the no claim discount are revised.

Our Cancer Insurance provides coverage for all stages of cancer, including early stage cancer which critical illness insurance or rider may not provide.

Information You Might Find Useful

Featured Articles

Does Sugar Cause Cancer? What’s The Link?

What can I eat if I am undergoing cancer treatment?

Things to know about Ovarian Cancer

See What Our Customers Say

Important notes:

This policy is underwriting by Etiqa Insurance Pte. Ltd. This advertisement has not been reviewed by the Monetary Authority of Singapore. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. As this product has no savings or investment feature, there is no cash value if the policy ends of if the policy is terminated prematurely. It is usually detrimental to replace an existing policy with a new one. A penalty may be imposed for early termination and the new plan may cost more or have less benefit at the same cost. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit us the Life Insurance Association (LIA) or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg). This product pays the same level of benefit regardless of severity of the condition, hence LIA’s common definition for the severe stage does not apply. This content is for the reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

Information is correct as of 18 February 2025 .

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.